Do you need to make a cash offer to win? This is a follow-up to an article I wrote back at the beginning of the COVID lockdown, “Lost to An All Cash Offer?”. It is still an exciting topic and one that has surprised me as I have looked further into the details of how things have changed in the last two years. First, having the ability to make a Cash offer does improve your odds of having your offer accepted, but I am unsure if it is worth the extra cost for buyers using a “Cash Lender”.

Did your agent tell you “You lost to an all-cash offer”? I am not sure I believe them and I do not think you should either. First as a seller’s agent, I do not have the ability to disclose any offer’s terms, unless my client has given me permission. When I ask my client if I can share terms, they normally ask my opinion, which is, I would not share unless there is a benefit to them.

And second, there is no benefit of sharing any offer’s terms before one has been selected. It can only lead to fewer offers. I do recommend sharing how many offers have been submitted. If there are already more than ten, it is likely no additional offer will be better than what has already been submitted.

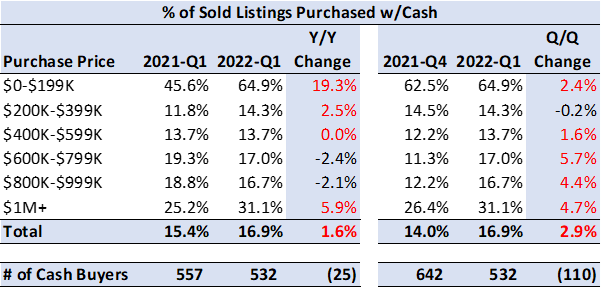

To the numbers and your agent’s hypothesis. Yes, the percentage of sold listings going to cash buyers is increasing (in Red), but not across all Purchase Price ranges. For buyers looking from $400K-$1M, which is where most buyers are, the % of cash buyers has decreased from Q1-2021 to Q1-2022. Also numerically, the number of cash buyers has decreased Y/Y also. So, what is driving the increase then? There are fewer listings, which means more going to cash buyers.

Let us pause for a second to absorb the table. I know it is hard to believe, because the story in the news is Cash is King for Making the Winning Offer. Again, it helps!

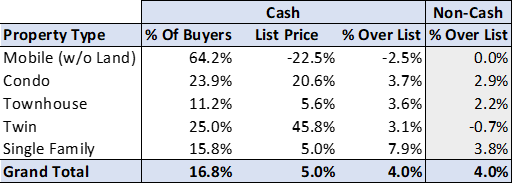

However, as illustrated in this next table, just because it helps, does not mean there is no consequence for using it. For Single Family homes in Q1-2022, cash buyers start at a list price 5% higher and spend move over list (7.9%) than Non-Cash Buyers (3.8%). This ends up costing them 8.4% more at the end of the day.

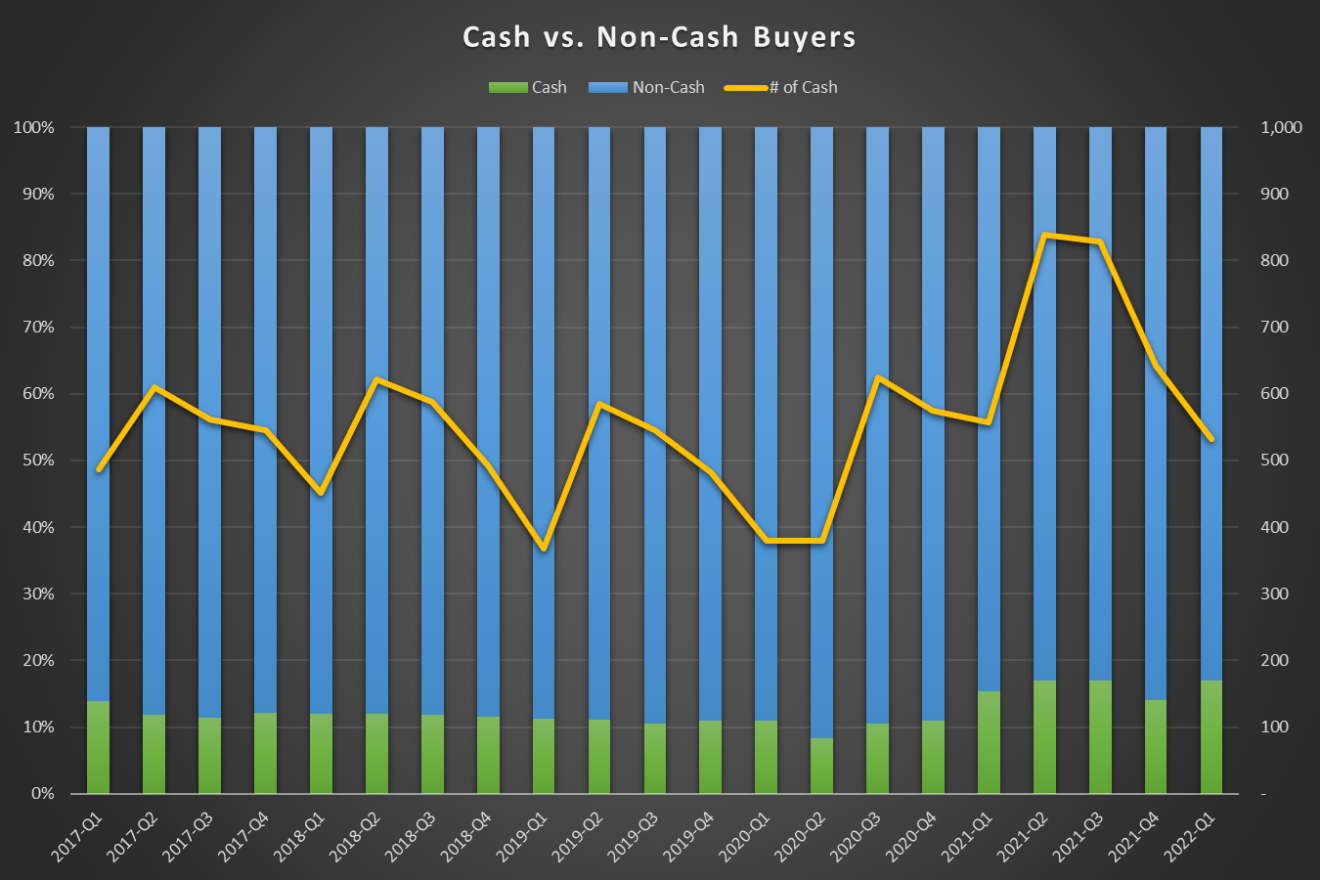

I am not a fan of the next chart, and will keep working on it, but what it provides is a historic view of Cash vs Non-Cash Buyers. And yes, there were more cash buyers in 2021 and so far in 2022. Before 2021, only about 11% of all transactions went to cash buyers, however in 2021 it jumped to 16%. In 2021, we also saw a 38% increase in the number of cash transactions. So, there is some truth to the news, but it has been this way for over a year.

Where did all the Cash Buyers come from? My guess, in no particular order, is buyers are using 1) Cash Lenders, 2) Liquidated Equity or Equity Based Loans and 3) The proceeds from the sale of their house.

So back to the story of Cash is King, it helps, but so does putting in the best offer you can. When I say best I mean:

- The highest offer you can make

- For loan contingent offers, the most money above appraised value you manage.

- A guarantee of being able to get to the closing table, aka non-refundable earnest money

I won’t tell you to give up your other contingencies, even though it might make your offer look better. It adds risk that you financially might not be able to manage later. Like finding something during Due Diligence that is a “walk away” thing, even if you lose non-refundable earnest money. At least the seller will have to disclose and possibly fix it for the next person.

If you want to make a Cash offer but don’t have Cash or Equity, there are several ways to get Cash. Many options will cost about 1% of the purchase price of your new home, in addition to fees for the refinance loan you will need to also get. I have access to a “Cash-Backed Lender”, RealSure, and would love to help you in securing your next home. But I am not sure you need to go this route, unless your crunched for time.

Anyway, thanks for your time. If you’d like to connect or share your thoughts, I can be reached via email at craig@craigtheagent.com.

P.S. Follow me on: Facebook, Instagram and LinkedIn. Also, this data was derived from UtahRealEstate.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link