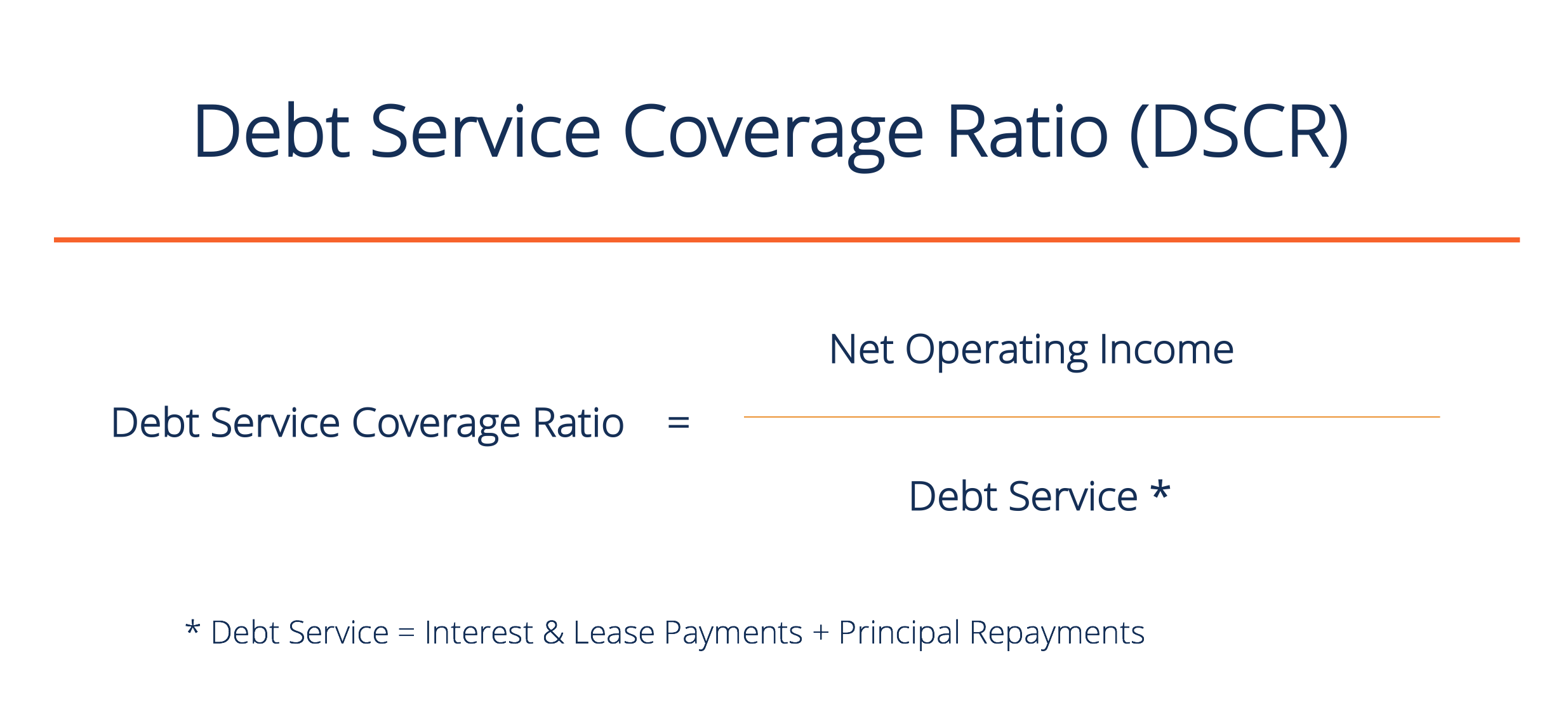

Are you a real estate investor looking to add properties or a person wanting to become a real estate investor? Do you have at least 20% for a down payment? The Debt Service Coverage Ratio (DSCR) loan may be the perfect option in either case to help you acquire your next property.

This is a great program to help investors buy rentals, without having to provide a laundry list of financials to the lender, as they are qualified as long as the property has a DSCR >1. Simplified, this means if the property can rent for more than the mortgage payment, then the investor is qualified. The loan still requires the borrower to have strong credit, a down payment and cash reserves.

It is a great loan for several reasons, but the biggest positive is the DSCR loan does not have the requirement for tax returns or paystubs, like a No-Ratio Loan. In many cases, investors will not qualify for a conventional loan even though they can afford to purchase, because most investors write expenses off against their properties to show limited income from their investments on their taxes.

Highlights:

- Qualifications based on property cash flow, not Owner’s Income

- Market rents are used to qualify (ex. Zillow’s Rent Zestimate®)

- No income documentation is needed

- Potentially quicker closing times

- No limit on the number of properties

- Interest-only loan option available

- Both long-term and short-term rentals are eligible (Airbnb, VRBO, etc.)

- Cash out Refinances (Up to 65% LTV)

- Will lend on Condo-Tel

- First-time investors allowed

Cons:

- Higher Interest Rate

- Required cash reserves

- Minimum 20% downpayment

Give Mark Moyes a call, (801) 999-0886, if you would like more information about your options with this and other types of loans.

Anyway, thanks for your time. If you’d like to connect or share your thoughts, I can be reached via email at craig@craigtheagent.com.

P.S. Also Follow me on: Facebook, Instagram and LinkedIn.

Disclaimer: I am not a Lender or Mortgage Broker! I cannot qualify you for a loan, I do not know what your cost or rate would be, nor do I know the full requirements for any of the loans. If you need help with financing, please talk with your lender.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link